Then you’ve come to the right place!

We advise entrepreneurs who are thinking about setting up a company in Cyprus.

As a tax consultancy firm, specializing in international tax structures, we are confident that we can find the best solution for each and every one of our clients.

You’ve probably already come across Cyprus in your search for tax-efficient company locations. And, in fact: Cyprus offers an attractive tax model with a taxation of only 12.5%. But did you know that you can count on better conditions elsewhere in the EU?

The solution? Malta!

What you don’t often hear about: Unless the shareholder is a Maltese citizen, he/she will get back 6/7 of the tax paid, hence just under 5% effective taxation

We seriously recommend to all our clients: move if you want to establish a company abroad.

The reason: Your company abroad needs substance in order to have a basis for taxation. You achieve substance by creating value locally – and that is only possible with genuine local business operations.

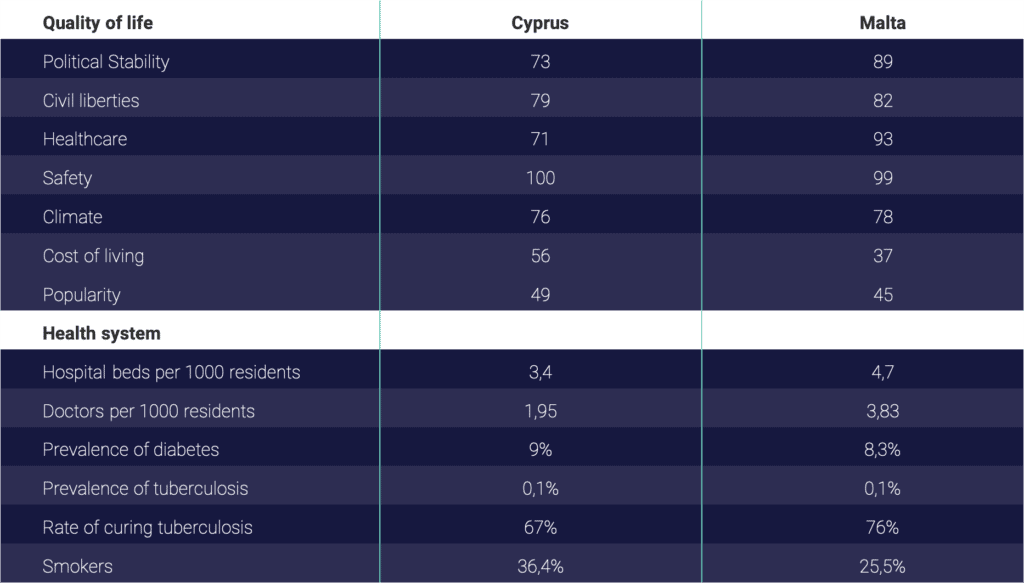

This also means: Can you really imagine living abroad at all? You’ll inevitably have to ask yourself this question. If the answer is yes, there’s nothing standing in the way of setting up a company. Where it’s Cyprus or Malta is ultimately up to you, but based purely on the facts, Malta is usually the better choice.

You might think to yourself: I’ll do the start-up myself. Or: I’ll hire a start-up agency.

Clearly, this would be the most favorable option for you in the short term. However, what many underestimate is that, in the meantime, there are a multitude of protective mechanisms in the country of departure that make founding a company an expensive prospect. There are tons of classic mistakes that just about everyone makes who has not been made aware of them. The result is high back taxes in the country of departure, which then make the venture outrageously expensive and far outweigh any tax savings.

Clean organizational structures, which are demonstrably legal and effective, and which also withstand the latest harmonizations of international tax legislation, can only be obtained with the help of experts.

Our employees have years of experience in the field of international tax with a focus on company formation. The advantage for you: Our experts are familiar with all current regulations and can provide you with comprehensive advice.

Mr. Wickinghoff has more than 15 years of professional experience in advising on company set-ups. He gained his expertise in London until he ultimately moved to Malta 10 years ago and has been advising entrepreneurs ever since. Mr. Wickinghoff thinks in a customer- and solution-oriented way, which is why he is highly appreciated by his clients.

Recognised international tax expert and Managing Partner of the firm. In the early stages of his career Philipp Sauerborn worked for Ernst & Young and Price Waterhouse Coopers in Zurich. Later he joined the tax firm St. Matthew in London as Head of Department and after three years there became Managing Director and Partner.

Lawyer Dr. jur. Jörg Werner is the founder of the law firm and came to Malta in 2011. In the course of his career, Dr. jur. Jörg Werner has focused on international corporate law. Before moving to Malta, he managed a medium-sized German company in England.

IMPORTANT: Dr. Werner & Partner attaches great value to its reputation as an honest and transparent law firm. Therefore, we will refuse requests that are purely tax motivated. We also advise companies to incorporate in Malta only if we believe it’s worthwhile for you. Conversely, what this means for you is that if we decide to partner with you, you can assume that your decision has been examined by us from all sides and that you will receive the best possible support and advice.

The law firm of DWP Dr. Werner & Partner has an international team, with both Maltese and German consultants. This is an advantage for you, as German tax law has been and still is leading the way for all changes in international tax law in recent years. Ultimately, the orientation towards German tax law has resulted in our clients being in the best possible position and having to undertake only minor restructuring, even after EU and OECD changes.

In addition, our advisors have many years of experience and have been able to grasp and penetrate all legislation and measures of states and are always eager to anticipate developments.

Together with a team of lawyers & tax experts we analyse your situation.

You tell us your plans and your needs. If necessary, we will involve a specialist consultant.

We create a holistic solution for you, in which all tax and legal aspects have been considered.

Dr. Werner & Partner has been serving clients for over 15 years and starts by offering you a free consultation in English, German, Russian, or Brazilian Portuguese. Dr. Werner & Partner’s broad service portfolio means that you receive comprehensive services from a single source. Even if you don’t benefit from all Dr. Werner & Partner’s services, at the very least it’ll behoove you to listen to the know-how of all our various specialists and see how the advice we provide is truly holistic.

You’re facing an important decision and are unsure whether and how to proceed?

You’re an entrepreneur and want to grow with your company beyond national borders? Are you looking for a partner you can trust?

Then let us advise you and find out how we can take you and your business to the next level.

Profit from our ambitious team and network!

We advise entrepreneurs who are thinking about setting up a company abroad, i.e. in Cyprus.

As a tax firm specialized in international tax, we can find the best solutions for each client.

© 2020 DWP Dr. Werner & Partner – All rights reserved